- The Coffee Break

- Posts

- ☕️ SC: Malaysian capital markets had a good 2024

☕️ SC: Malaysian capital markets had a good 2024

BIMB Research: Sapura Energy could achieve sustainable profit in FY2027. Greenpeace to pay USD660 mil to oil company over pipeline protests. Telegram: 1 bil CEO swipes at WhatsApp - calls rival an "imitation".

2. NUMBERS AT A GLANCE 🔢

64th in global happiness rankings – Malaysia’s rank in the 2025 World Happiness Report, placing it in the middle among Southeast Asian nations. It trailed behind Singapore (34th), Vietnam (46th), Thailand (49th), and the Philippines (57th), but outperformed Indonesia (83rd). The report highlighted factors like GDP per capita, social support, and freedom as key determinants of happiness, which can shape a country’s trajectory. Malaysia’s ranking has declined compared to previous years, pointing to challenges in economic confidence and social well-being that may need addressing to improve national happiness levels.

The global debt-to-GDP ratio rose for the first time since 2020, reaching 328% as the world’s debt stock hit a record USD318 trillion (RM1.4 quadrillion) by the end of 2024, according to the Institute of International Finance (IIF). The increase, driven by USD95 trillion in government debt, coincided with slowing inflation and economic growth. While the USD7 trillion rise in global debt was less than half of 2023’s surge, the IIF warned that persistent fiscal deficits could provoke a backlash from bond markets.

Only 17.5% of Japanese nationals held passports at the end of 2024, a stark contrast to other advanced economies, according to the Ministry of Foreign Affairs. Despite Japanese passports being among the world’s strongest—offering visa-free access to 190 destinations—rising overseas costs and declining travel interest among younger generations have dampened demand. In 2024, 3.82 mil passports were issued, a slight increase from 2023 but 700,000 fewer than in 2019, pre-pandemic. Around half of the new passports went to people under 30, while those aged 60 and older accounted for just 13%, reflecting shifting travel trends in Japan.

3. IN MALAYSIA 🇲🇾

We end the week with a special - the Securities Commission (SC)’s 2024 Annual Report

The Securities Commission Malaysia (SC) announced that the Malaysian capital market has enjoyed a fairly good year in 2024 by growing to RM138.9 bil, an 8.8% bump compared to 2023. The ‘ong’ double eight growth figure was driven by a surge in initial public offerings (IPOs), robust bond issuances, and renewed investor confidence. Malaysia has registered a whopping 55 IPOs, an increase of over 70% compared to the 32 IPOs recorded in 2023. However, the bond and sukuk market remained a key driver of capital formation, contributing RM124.2 bil to the total funds raised. SC is so fond of the bond and sukuk market that it has decided to introduce the tokenisation of bonds and sukuk this year in collaboration with Khazanah Nasional Bhd. Before this, the sukuk and bond market was mostly accessible only to sophisticated investors, but with this tokenisation effort, it will be more accessible to retail investors.

So, how does tokenisation work? Tokenising bonds, by representing them as digital tokens on a blockchain, makes them more accessible to retail investors by allowing fractional ownership and facilitating easier, faster, and more transparent trading, potentially lowering barriers to entry.

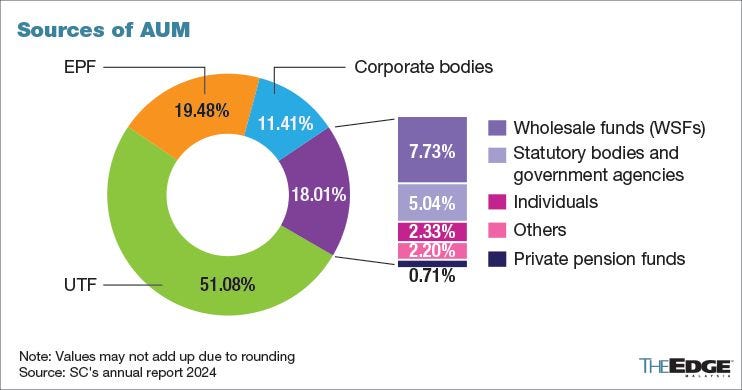

Coming back to our coverage of the SC 2024 Annual Report, Malaysia’s investment management industry has joined the trillion Ringgit club after the industry recorded assets under management (AUM) of RM1.07 tril as of December 31, 2024, a 9.7% increase from the level recorded in 2023. Strong unit trust fund (UTF) sales played a key role in driving AUM growth, benefiting from positive valuation effects in the equity market.

All looks good for the Malaysian capital market but the situation is gloomy for SC itself. SC executive chairman Mohammad Faiz Azmi announced that SC is still bleeding money, and recorded a total comprehensive net loss of RM2.11 mil for FY2024. However, the loss recorded in FY2024 seems like peanuts when compared to the net loss registered in FY2023, a whopping RM107.86 mil. So, kudos to Faiz and the team for paring the losses. To finally bring SC back to the black, Faiz stated that SC is looking to introduce a new fee structure for capital market intermediaries by 2026. However, the new fee structure will be based on a variable model rather than a fixed fee, as the latter could be burdensome during market downturns. The new structure will be submitted to the Ministry of Finance by the end of March 2025 for approval.

Bad weather is hitting the Malaysian coast soon

Malaysian Meteorological Department (MetMalaysia) director-general Dr Mohd Hisham Mohd Anip announced that the monsoon transition phase is expected to begin on March 25 until May, potentially triggering flash floods as heavy rain and strong winds over a short period will be common. The affected areas include most areas in western and inland Peninsular Malaysia, as well as western Sabah and Sarawak.

Unfortunately, the bad weather season has already hit Johor as five districts - Johor Bahru, Kota Tinggi, Kulai, Pontian and Kluang have suffered severe flooding that led to the evacuation of 2,550 residents as of yesterday evening. Johor Education and Information Committee chairman Aznan Tamin said that schools in every district are ready to be activated as temporary relief centres (PPS), if necessary.

For your information, floods are a real menace in Malaysia as the country has suffered RM933.4 mil in losses from flood-related damages in 2024 alone. According to the Department of Statistics Malaysia (DOSM), the figure is up 23% compared to the previous year. By states, Kelantan, Terengganu, and Kedah suffered the most, particularly in housing and business premises. Since the ‘worst flood in a century’ in 2021 that led to RM6.1 bil in losses, Putrajaya has spent RM22.57 bil in 120 flood mitigation projects nationwide.

Shorts:

Prosecution: Syed Saddiq’s actions driven by political mileage

During Syed Saddiq’s appeal regarding his conviction in a misappropriation case involving RM1.12 million of Bersatu Youth's funds, prosecutor Wan Shaharuddin Wan Ladin told the court that the Muar MP was driven by political mileage to instruct Bersatu Youth's former assistant treasurer Rafiq Hakim Razali to withdraw RM1 mil from the political party's bank account. Wan Shaharuddin stated in the court that the money was withdrawn due to ‘worries over a change of Bersatu Youth leadership’ and the money is Syed Saddiq’s ‘titik peluh’, so he allegedly felt that he had the right to use the money. At the moment, if his conviction and sentencing stand, he will be sent to seven years in jail with an RM10 mil fine and two rotan strokes. Appeal proceedings will resume on April 17.

BIMB Research: Sapura Energy could achieve sustainable profit in FY2027

Mark your calendar as BIMB Research predicted that the troubled Sapura Energy Bhd could achieve sustainable profit from FY2027. This is likely to come with cost savings from its debt restructuring plan and a sustained order book in the drilling and operations and maintenance (O&M) segments. The research house projected that Sapura Energy would be able to deliver a core profit of RM134 mil in FY2027. May this bailout strategic investment bear fruit.

Pharmaniaga fundraising proposal approved

Another PN17 company, Pharmaniaga Bhd, saw its proposal to raise as much as RM653.52 mil in cash, part of the company’s revised regularisation plan, approved by its shareholders. The proposed regularisation plan includes an RM520 mil capital reduction, a rights issue to raise up to RM353.52 mill and an RM300 mil private placement. The company’s major shareholders, Boustead Holdings Bhd (47.1%) and Lembaga Tabung Angkatan Tentera (LTAT) (7.8%), have given undertakings to subscribe to their entitlements to the rights issue. Based on a back-of-envelope calculation, Boustead is expected to contribute up to RM166.58 mil, while LTAT's portion amounts to RM27.68 mil.

4. AROUND THE WORLD 🌎

Israel launches new ground operation in Gaza

After its deadly attacks that violated the ceasefire on Tuesday, the Israeli military announced on Mar 19, 2025, that it has launched a new ground operation in Gaza, extending control over the Netzarim Corridor, which bisects Gaza. This was a “focused” manoeuvre aimed at creating a partial buffer zone between the north and the south of the enclave.

Palestinian militant group Hamas said the ground operation and the incursion into the Netzarim Corridor were a “new and dangerous violation” of the two-month-old ceasefire agreement. Hamas reiterated its commitment to the deal and called on mediators to “assume their responsibilities”.

Defence Minister Israel Katz issued a video statement warning Gaza residents that evacuation from combat zones would begin shortly. He said airstrikes were “only the first step” and if the hostages were not released, “Israel will act with force you have not yet seen”. Netanyahu’s decision to resume bombardments has triggered protests in Israel as 59 hostages are still held in Gaza, with 24 of them believed to be still alive.

Greenpeace to pay USD660 mil to oil company over pipeline protests

A jury in the US state of North Dakota has ordered Greenpeace to pay USD 660 mil in damages in a defamation lawsuit brought by oil pipeline operator Energy Transfer, a Texas company worth USD64 bil. The company was awarded damages across three Greenpeace entities, citing charges including trespass, nuisance, conspiracy, and deprivation of property access.

Greenpeace, standing alongside the indigenous Standing Rock Sioux Tribe, has been protesting against the Dakota Access Pipeline for almost a decade, in one of the largest anti-fossil fuel protests in US history. The environmental groups and Tribes opposed the pipeline because of the greenhouse gas emissions from the oil that it carries and concerns that a spill would contaminate state and tribal drinking water.

Interestingly, lawyers from the Trial Monitoring Committee said many of the jurors had ties to the fossil fuel industry, with some openly admitting they could not be impartial but seated by the judge anyway. The case has raised serious free speech concerns. It comes as the Trump administration is seeking to instate a wider crackdown on freedom of expression across the country and to open up the US to fossil fuel expansion by eliminating air and water protections. Trump’s campaign slogan for the expansion was “drill, baby drill”.

Telegram’s 1 billion user mark and SoftBank’s latest chip-related deal

Telegram hits 1 billion active users as CEO calls WhatsApp an “imitation”

Telegram CEO Pavel Durov announced in his personal Telegram channel that the messaging app has reached a staggering 1 bil monthly active users and has raked in USD547 mil in profit in 2024. In his post he also took a shot at Telegram rival WhatsApp, calling the Meta-owned app a “cheap, watered-down imitation of Telegram”, which has been “desperately trying to copy our innovations”. Durov was only recently allowed to return to Dubai after being held in France for months for charges related to multiple offenses, including "complicity" in the distribution of child sexual abuse material and drug trafficking on Telegram while refusing to cooperate with the authorities' investigation into the platform. He was released on a USD5.6 mil bail.

SoftBank to acquire chip designer Ampere in USD6.5 bil deal

Japanese giant SoftBank Group has announced a USD6.5 bil deal to acquire Ampere Computing, a startup that designed a server chip based on the architecture of British chip company Arm. The deal is expected to close in the second half of 2025. SoftBank said that Ampere’s expertise in semiconductors and high-performance computing will help deepen their commitment to AI innovation in the United States. SoftBank has been broadening its investments in AI infrastructure, including a partnership with OpenAI announced last month to create enterprise level AI and through its involvement in US President Donald Trump’s USD500 bil private AI investment project Stargate.

Shorts:

Indonesia passes controversial law revision allowing greater military role in government

Indonesia’s Parliament recently amended a law to allow members of the military to hold more civilian posts, raising concerns that it could usher in a resurgence of the military in government affairs similar to late dictator Suharto’s reign. President Prabowo had once served Suharto and was once his son-in-law. Ministers were quick to deny a return to military dominance, stating that the amendment was necessary due to domestic and geopolitical challenges.

Sales of Baby Three doll in Vietnam plunge over face marking like China’s ‘nine-dash line’

Sales of a popular Chinese-made doll in Vietnam, Baby Three, has plunged due to heavy accusations that a marking on the doll’s face bears a resemblance to China’s “nine-dash line”. The line was what China inserted on world maps to indicate its territorial claim over most of the South China Sea, which was disputed by many countries including Vietnam. Vietnamese children started to boycott the dolls as it was becoming unpatriotic to own one. Between September, when it first gained popularity, and December, the dolls reportedly generated USD1.6 mil in sales.

China executes 4 dual Canadian citizens

Four Canadians have been confirmed to be executed by the Chinese government for drug-related offences this year despite multiple pleas for clemency by the Canadian government. The four Canadians were also dual Chinese citizens, a status that Beijing does not recognise. The Chinese embassy in Ottawa told Canadian media that they had been granted a fair trial and due process in “strict accordance with the law”. Canada strongly condemned the executions, which had added to souring ties between the two nations.

5. FOR YOUR EYES 📺

Some of you may be aware that we’re a fan of the Hot Ones on YouTube. Another channel spew some truth about the show’s heat rating of the sauces.

We’re much more privileged than we think we are.

Thread of photos from families in each quartile of income in the world: first photo is from the poorest 25%, last photo is richest 25%.

Based on these photos, which income bracket are you in?

First up: Toilets— Aella (@Aella_Girl)

11:19 PM • Mar 14, 2025

Boston Dynamic released its latest video of its humanoid robot pulling off some break-dancing moves. Every new video starting to look more and more human-like. Some peace of mind for you - the company in Oct 2022 signed a pledge saying it would not support any weaponisation of its robotic creations.

Fun fact: Founded in 1992 through a spinoff from Massachusetts Institute of Technology (MIT), the company was acquired by Google X in 2013, then sold to SoftBank in 2017 and in Dec 2020, Hyundai Motor Group bought an 80% stake from SoftBank for USD880 mil, and ultimately took full control in Jun 2021.