- The Coffee Break

- Posts

- ☕️ Muhyiddin’s SIL Adlan Berhan still on the run

☕️ Muhyiddin’s SIL Adlan Berhan still on the run

Make better use of Malaysia's child sex-offender registry to protect our children. Lynas Rare Earths expands in Malaysia. Rafizi opens affordable social enterprises. MGAG parent acquired by global ad giant.

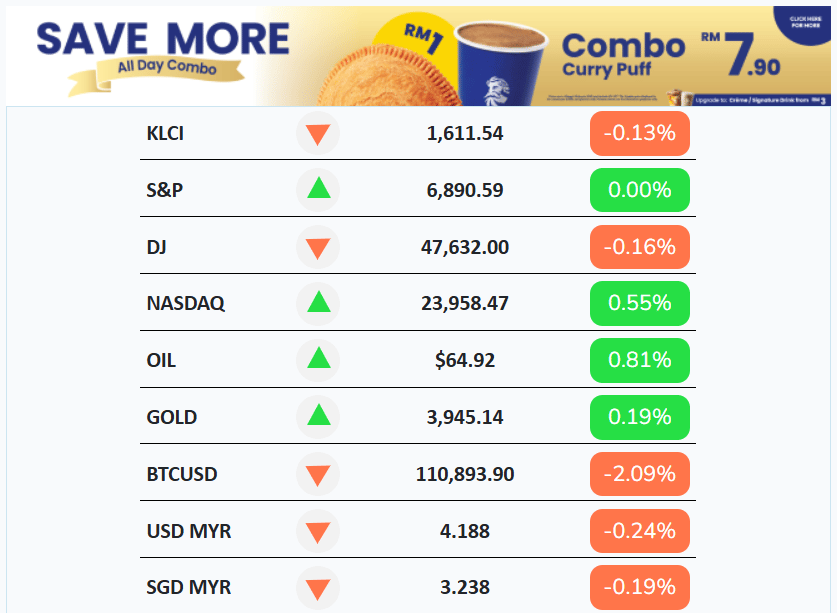

2. NUMBERS AT A GLANCE 🔢

Think bank interest rates are bad? A major illegal loan shark syndicate in Johor, responsible for at least 34 cases of criminal intimidation, has rates of up to 50%. These rates were imposed even if the borrowers did not agree to the conditions of the loan agreement. Thankfully, police have arrested three members of the syndicate, crippling their operations. An initial investigation revealed that the three arrested individuals were paid RM1,000 for each act of treachery with fire and RM550 for paint spraying, including pasting a threatening notice at the victim’s house. So, is the note a value-added service or something?

In 2024, Malaysia produced over 55,000 tonnes of electronic waste, or e-waste, according to the Environmental Quality Report 2024. However, the Natural Resources and Environmental Sustainability Ministry pointed out that the approved processing capacity for e-waste last year was 131,004 tonnes, meaning less than half of the capacity was used. This is despite various public campaigns to increase awareness of e-waste processing.

Pandan MP Rafizi Ramli called for more attention to be given to debt service costs, what he calls the most toxic component of government spending in the year ahead. He pointed out that the sharp escalation in debt service payments puts Malaysia at real risk of breaching its debt ceiling of 65% of its gross domestic product (GDP). According to the former economy minister, actual debt service costs have continued their upward trajectory to RM58.3 bil in 2026 from RM40.5 bil in 2022, an increase of RM17.8 bil. This, he said, effectively wipes out the RM18 bil the government saved from the rationalisation of subsidies and social aid over the same period.

Rafizi further warned that the country’s true debt exposure is much higher once one-off balance sheet liabilities are factored in. As of 2024, government guarantees for projects amounted to RM332.8 bil, about 17.2% of GDP. As of June, Malaysia’s total domestic and external debt stood at RM1.3 tril, about 64.7% of GDP. Combined, this places Malaysia’s total debt exposure to about 81.9% of GDP, blowing past the debt ceiling.

3. IN MALAYSIA 🇲🇾

YTL and Yinson invest in New Zealand

YTL Corporation’s hospitality arm, YTL Hotels and Properties Sdn Bhd, has made its first foray investing NZD160 mil (RM388 mil) to acquire the 225-room Hotel Indigo in Auckland, the country’s second-biggest hotel deal this year. At the same time, Yinson Renewables is preparing projects totalling around 1GW in renewable energy, though the value hasn’t been disclosed. New Zealand PM Christopher Luxon said the investments show strong ties with Malaysia and confidence in the local market, while YTL Hotels’ Datuk Mark Yeoh believes the move highlights the group’s long-term commitment to tourism and hospitality in the region.

Make better use of Malaysia’s child sex-offender registry to protect our children

Experts say every organisation working with children should screen staff through Malaysia’s Child Sexual Offenders Registry (e-DKK), as weak checks leave kids vulnerable. Suhakam Children’s Commissioner Dr Farah Nini Dusuki stressed that safeguarding children isn’t just about safe spaces but hiring the right people. She called for stricter licensing rules, better staff vetting, and more awareness of the e-DKK which has been around since 2019 but is under-utilised. Managed by the Welfare Department, the registry currently only covers sexual offences by convicted offenders, limiting its effectiveness since many cases collapse on technical grounds. Be My Protector vice-chair Dr Isdawati Ismail said the system shouldn’t sit idle, suggesting wider access for schools, childcare centres, and religious institutions, a tiered access model, integration with the Children Service System (Anak), and laws to make screening mandatory. Linking e-DKK with Anak, is about prevention, stopping offenders at the gate before they ever reach children. Welfare Department page for screening with e-DKK here. There’s a form to check whether a person being considered for a position around children is on the list.

Lynas Rare Earths expands in Malaysia

Lynas Rare Earths Ltd is pouring RM500 mil into a new rare earth separation plant in Malaysia to meet rising demand for non-Chinese supply. The facility, which will process up to 5,000 tonnes of heavy rare earth inputs annually, will use feedstock from Lynas’ Mount Weld mine in Australia and future sources including ionic clay deposits in Malaysia. The demand for heavy rare earths remains strong, allowing the company to be selective with its buyers and pricing. Lynas’ Malaysian site is currently the only commercial producer outside China, giving it a strategic edge as global supply chains shift. Construction will depend on regulatory approval, with samarium production expected to start by Apr 2026, followed by gadolinium for medical imaging and dysprosium for EV and wind turbine magnets.

MACC Lookout

Muhyiddin’s SIL Adlan Berhan still on the run

Fugitive businessman Muhammad Adlan Berhan is believed to be travelling abroad using an alternative passport after his Malaysian one was revoked. Authorities have received reports and sightings of Adlan overseas, possibly in Thailand or the Middle East, but his exact location remains unknown. The 49-year-old, son-in-law of former PM Muhyiddin Yassin, has been on the run for over two years over alleged criminal breach of trust. He left for New Zealand in May 2023, shortly after his father-in-law faced corruption charges. Photographs suggest he has been moving between the Middle East and Thailand, attending golf outings and shooting ranges. The MACC is now tracing his overseas assets and properties with a view to freezing them.

KLIA Aerotrain under scrutiny

The MACC says it will only investigate the KLIA Aerotrain project if there are complaints of corruption or abuse of power. No confirmed papers have been opened yet, noting that many issues may fall under management or governance lapses rather than criminal offences. The aerotrain, which has faced repeated disruptions, most recently on Oct 28, is operated by MAHB with contractors IJM-PESTEC and Alstom responsible for its power system. The Land Public Transport Agency (APAD) has been instructed to take action to ensure accountability and maintain service standards as the aerotrain moves beyond its initial adjustment phase.

Shorts

ASEAN Power Grid proves its worth

Singapore and Thailand supplied 500MW and 300MW of electricity to Malaysia during the Oct 15 outage, showing the Asean Power Grid’s value in regional energy security. The government will launch the Large Scale Solar (LSS 6) programme next year, building on LSS 5 and 5+, which added 3.9GW capacity, RM12 bil in investments and 23,400 jobs. A new 300MW quota for biogas, biomass and small hydro under the Feed-in Tariff will start by 2028, while the Corporate Renewable Energy Scheme (CRESS) will generate 500MW. The government also agreed in principle to include nuclear power, though any decision will follow full safety, policy and technical checks.

Rafizi opens affordable social enterprises

Pandan MP Rafizi Ramli is opening two social enterprise outlets, Fleximart and Kesum, offering meals and essentials for under RM5. Fleximart in Section 7, Shah Alam, opens Nov with ready-to-eat meals and basics, while Kesum in Pandan Indah also starts Nov with affordable breakfast, lunch and dinner. Both run on a profit-sharing model, splitting earnings among investors, staff and the public, with some reinvested to keep prices low. If the pilots go well, more outlets are expected under the Ayuh Malaysia initiative. Affordable meals under RM5 with profit-sharing sounds great on paper, now the challenge is making it work in reality.

Together with TEDxKL

TEDxKL returns on 15 November 2025 at REXKL with the theme Confluence. One of the world’s pioneering TEDx events, TEDxKL celebrates the intersections of disciplines, cultures, and ideas—reflecting KL’s own origins. This fully in-person experience promises inspiring talks, powerful stories, and real-time networking with changemakers, entrepreneurs, and visionaries from Malaysia and beyond. Enjoy an exclusive RM30 discount by booking with this link.

4. AROUND THE WORLD 🌎

Trump breakthrough for US-South Korea trade relations

US President Donald Trump announced that the trade deal between the US and South Korea has been “pretty much finalised” after a meeting with South Korean President Lee Jae Myung, with “dramatic progress” on the day of the talks. The two leaders agreed that the USD350 bil (RM1.46 tril) investment, which Seoul promised in Jul for more favourable tariffs, can be split into two parts. The first will see USD200 bil in cash to be paid in instalments capped at USD20 bil per year, while the remainder USD150 bil will be spent on investments in shipbuilding. Both sides also agreed to split profits 50/50 from the projects taken on. This pushed tariffs for South Korean auto and auto parts down to 15% from 25%, with South Korean chipmakers also promised they will not be at a disadvantage to Taiwanese competitors.

Trump is also optimistic about a trade deal with China after he meets Chinese President Xi Jinping. He expects to lower US tariffs on Chinese imports in exchange for a commitment from Beijing to curb exports of fentanyl precursor chemicals. He may also speak to Xi about Nvidia’s Blackwell AI chips. This may indicate changes to chip export controls in the US. Beijing has reported it is ready to work towards positive outcomes with the US. However, China has also indicated it “absolutely will not” rule out the use of force over Taiwan, an issue that has been a sticking point in the past during talks between the superpowers.

By the way, something historic happened. Trump is the first US president to receive South Korea’s highest decoration, the “Grand Order of Mugunghwa”. He was presented with the award, along with a golden replica of the delicate Cheonmachong crown. Oh, he was also served mini beef patties with ketchup and rice for dinner.

Money matters

MGAG parent acquired by global ad giant

Singapore influencer group Hepmil Media Group, parent company of meme websites SGAG, MGAG, and PGAG, has been acquired by advertising and public relations giant Publicis Groupe. However, the valuation of the deal was undisclosed. Hepmil was established in 2015 and now has a network of over 3,000 content creators serving over 450 brands in six Southeast Asian markets. The deal will see this network combined with Publicis’ data capabilities, specifically a database of over 800 mil consumer profiles in Southeast Asia. Publicis believes the move to be highly strategic, as it will tap the growing influencer marketing sector in Southeast Asia. The sector is expected to grow up to 15% in the next five years, with expenditure for influencer marketing likely to surpass USD1.4 bil (RM5.9 bil) by 2030.

Saudi Arabia to shift focus of USD925 bil (RM3.5 tril) fund after gigaproject delays

The sovereign fund, called the Public Investment Fund (PIF) will be shifting its focus away from the real estate gigaprojects that have dominated its development goals in the last decade. Said projects, which include the futuristic city NEOM and a plan to host international winter sports using manmade snow, have faced repeated delays. In a move to secure more sustainable near-term returns, PIF will instead turn to existing developments, such as logistics, mineral exploitation, and religious tourism. Saudi Arabia will also be betting on AI investments and data centres powered by its energy resources. The kingdom has also made big investments in gaming, a favourite pastime of Crown Prince Mohammed bin Salman. The latest is a USD55 bil (RM230.37 bil) buyout of game developer Electronic Arts, known for the “Battlefield” and the “Madden NFL” series.

Transport woes

Nissan, Mercedes sound alarm on dwindling chip supply

The two were the latest global automakers to sound the alarm over the supply issue, which highlights the growing fallout from a trade and intellectual property stand-off between China and the Dutch government over chipmaker Nexperia. China banned exports of Nexperia’s finished products from its Chinese plants after the Dutch government seized control over the chipmaker, citing concerns about the possible transfer of technology to Nexperia’s Chinese parent, Wingtech, which has also been flagged by the US as a possible national security risk. This is also a clear reminder of the vulnerability of automakers in the face of trade tensions between the West and China.

China says no more EV subsidies

Top policymakers omitted electric vehicles from their list of strategic industries in the recent five-year development plan for 2026 to 2030 for China, which marks the industry’s first exclusion in over a decade. This sends a clear signal that China is willing to pull the plug on subsidies for its EV industry after years of support led to vast oversupply. Analysts believe the decision is evidence that Beijing now sees the industry as mature and no longer requires the same level of financial support, leaving the sector’s development to market forces. Analysts also cautioned that the omission should not be seen as a sign that the EV industry has fallen out of favour with the Chinese government, suggesting it is more of a strategic decision to allocate resources to other technologies, especially with global trade and security tensions.

Shorts:

Climate fund makes largest deal yet by backing USD6 bil Jordan water project

The Green Climate Fund, the world’s largest multilateral climate fund, made its largest financial commitment to date to help build a USD6 bil (RM25.1 bil) water desalination project in Jordan. This project, also one of the largest in the world, will eventually serve nearly half of the population of Jordan, which has the second-lowest water availability of any country worldwide. The US has pledged USD300 mil in grants and a further USD1 bil in loans for the project, with other countries in the region also expected to contribute. The backing from the fund will allow the desalination project to lower the cost of water by 10 cents a litre and save the government USD1 bil over its lifetime.US government inks USD80 bil (RM335.08 bil) deal for new nuclear reactors

The deal with the Canadian owners of Westinghouse Electric is one of the most ambitious plans in US atomic energy in decades, especially with US power demand boosted for the first time in two decades by the growth in AI data centres, which have strained parts of the power grid. The deal will see the US government arrange financing and help secure permits for Westinghouse reactors. In return, the US government will get a 20% share of future profits, but only after Westinghouse has paid out profits of USD17.5 bil to Brookfield and Cameco, the owners of Westinghouse. The profits can also be turned into an equity stake of up to 20%, though Westinghouse will need an IPO by 2029 if the value passes USD30 bil (RM125.7 bil).

5. FOR YOUR EYES 📺

Unkind truth vs kind lie.

Everyone I know that’s worked for Elon has experienced this.

The feedback is rough and expectations are exacting.

But it creates a system that’s more and more functional over time (to the point of accomplishing semi-impossible things)

Winners prioritize truth over

— Arthur MacWaters (@ArthurMacwaters)

3:36 AM • Oct 28, 2025

All good things in life come with cost of entry.