- The Coffee Break

- Posts

- ☕️ 359k PTPTN borrowers never paid a single sen, owing RM5.25 bil (average RM14.62k per defaulter)

☕️ 359k PTPTN borrowers never paid a single sen, owing RM5.25 bil (average RM14.62k per defaulter)

The RM1.87 mil Pokemon collection found a buyer. Trump says no to ‘third’ term presidency workaround. Philippine central banker: time to take profit on gold.

We made an error yesterday. Timor-Leste is the latest and 11th member of ASEAN, not 12th. The other country, Papua New Guinea, just holds observer status. Our apologies.

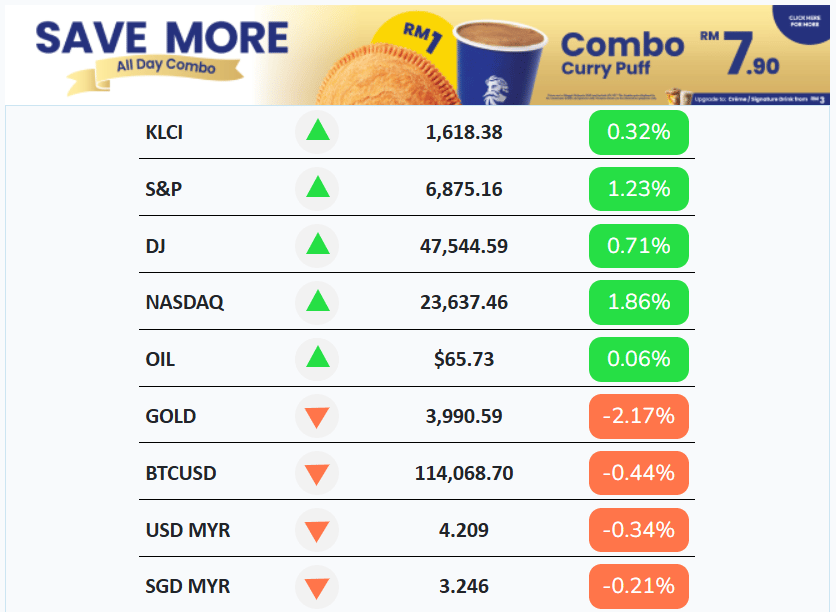

2. NUMBERS AT A GLANCE 🔢

The 60,000 aviation safety staff responsible for keeping American skies safe have gone unpaid through the government shutdown, and will soon be forced to dip into savings, rack up debt, or take on part-time jobs to make ends meet. The last time they received a paycheck was mid-October, and even those were missing two days’ worth of pay. The US Transportation Department has shared information on how to make donations of food, clothing, or other items to Transportation Security Administration staff, and airports have plans to organise food shelves for their staff. The 35-day shutdown back in 2019 saw increasing absences among air-traffic controllers and, leading to longer passenger wait times and delayed air traffic. These delays pressured lawmakers to end the shutdown quickly.

Supply chain disruption will cost global airlines extra this year, to the tune of over USD11 bil (RM46.3 bil), according to a study by the International Air Transport Association. The study was an effort to quantify the impact of a five-year supply chain crisis that has driven up fares and caused flight cancellations. Researchers found that the largest impact would come from USD4.2 bil in extra fuel, with additional maintenance and leasing engines to cost another USD3.1 bil and USD2.6 bil each. Having spare parts to cushion delays will also cost airlines a further USD1.4 bil.

1.7 mil paid streaming subscribers. That’s the number of people who cancelled their Disney subscriptions in the immediate aftermath of ABC pulling Jimmy Kimmel from the airwaves due to a misinterpreted comment. The cancellations were due to the suspension of Kimmel’s show after US President Donald Trump’s Federal Communications Commission pressured TV stations to drop the late-night host, who has since returned to the air. 1.7 mil was 436% above a subscriber loss typical for a four-day period.

Fun fact: Disney announced Kimmel was coming back shortly before they announced a planned price increase for their Disney+ service.

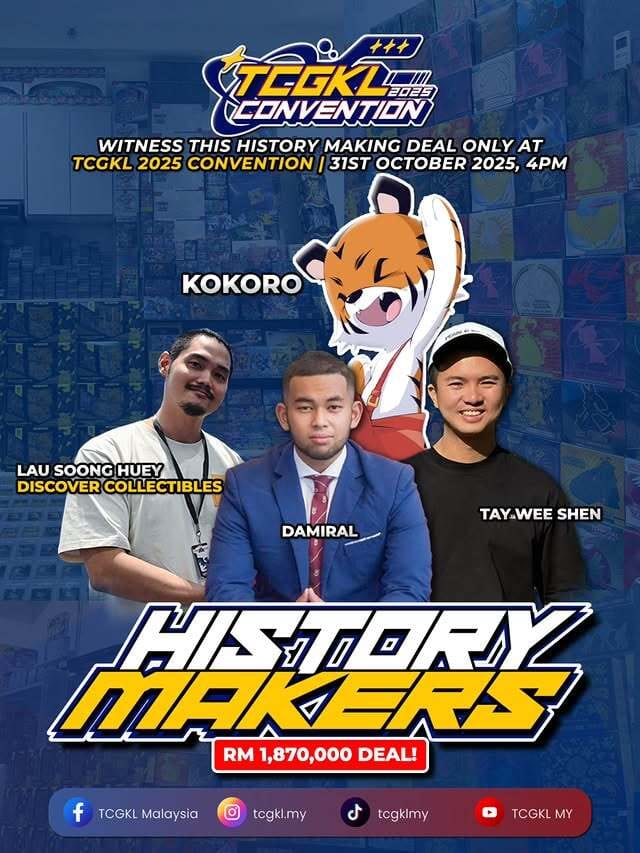

Remember the Pokemon collection for sale that went viral? It has been sold to local cryptopreneur and luxury watch dealer Tay Wee Shen. The collection will be handed over at the Trading Card Game Kuala Lumpur Convention on October 31 at 4PM.

3. IN MALAYSIA 🇲🇾

Rare earths, not rare jobs

Malaysia is keeping its ban on exporting raw rare earth elements but wants foreign investors to come in for downstream processing and value-added work instead. The policy, meant to boost local jobs and industries, applies to everyone: the US, China, Japan, Korea, you name it. As Malaysia stays neutral amid the global rush for critical minerals. Malaysia and the US signed a trade deal to strengthen economic ties and supply chain resilience, with Malaysia agreeing not to block exports of processed rare earths to American firms. While the government hasn’t put a number on how much the sector could bring in yet, geological validation work is ongoing with help from the private sector, funded through a Budget 2026 allocation. PM Anwar Ibrahim announced in the 47th ASEAN Summit that Malaysia is also open to working with Japan across the full value chain from mining and refining to manufacturing, as long as it adds value at home.

Teenagers caught in dark online hustles

A nationwide crackdown on child sexual abuse material (CSAM) has taken a grim turn, with police arresting 31 men including 6 minors, one as young as 12 under Ops Pedo 2.0. One 17-year-old reportedly made RM76,000 in just 9 months selling such content online. Over 880,000 pornographic files were seized, 20 times more than last year’s operation, revealing a disturbing rise in children’s involvement and even religious teachers among the culprits. The materials, some sold for as little as RM30, were traded across social media, e-wallets, and the dark web. Inspector-General of Police Mohd Khalid Ismail urges families to boost digital awareness and moral guidance, as police move to tighten enforcement against those who exploit children for profit.

Meanwhile, adult video company Pornhub revealed the top 4 consumers in Malaysia by time spent watching: Kuala Terengganu, KL, Kota Bahru and Miri.

Farhash vs Rafizi: social media goes courtroom

Former aide to PM Anwar and businessman Farhash Wafa Salvador Rizal Mubarak has taken former economy minister Rafizi Ramli to court over two allegedly defamatory videos posted on social media. The suit follows Rafizi’s refusal to apologise after releasing videos on Jul 25 and Aug 20, which Farhash claims tarnished his name and painted him as being involved in shady business dealings, including a syringe attack on Rafizi’s son. Farhash, also formerly Perak PKR chief, is seeking RM10 mil in damages, saying the accusations had hurt his reputation in the business world and led to public ridicule. Apparently, investors and partners lost confidence in him despite being cleared by the MACC in Sept over a separate coal mining licence allegation.

𝗦𝗔𝗠𝗔𝗡 𝗙𝗔𝗥𝗛𝗔𝗦𝗛

Hari ini, akhbar The Edge melaporkan bahawa Farhash Wafa Salvador, bekas Setiausaha Politik Dato’ Seri Anwar Ibrahim telah memfailkan saman terhadap saya di mahkamah.

Ia berkaitan dua video saya yang dituduhnya telah menjatuhkan reputasinya sebagai

— Rafizi Ramli (@rafiziramli)

10:52 AM • Oct 27, 2025

Battersea Power Station: Malaysian owners cash out?

London’s iconic Battersea Power Station, home to Apple’s UK HQ and a massive shopping mall, is reportedly up for sale. The Malaysian owners, including the Employees Provident Fund (EPF) and Permodalan Nasional Bhd (PNB), have brought in BNP Paribas to explore potential buyers after receiving interest from investors. The building, last valued at nearly GBP1.6 bil (RM8.96 bil) in 2019, was part of a GBP400 mil acquisition in 2012 by a Malaysian consortium that transformed the derelict site into one of London’s biggest redevelopments. The sale excludes the residential units, which remain under the original developers. A sale of this scale would mark one of the UK’s biggest property deals since interest rates began climbing in late 2021, a far cry from the power station’s days as a relic of London’s industrial past.

Where do defaulters go? Abroad

PTPTN defaulters living it up abroad

Turns out about 30% of PTPTN’s 1.2 mil defaulters are still managing to go on holidays abroad, even though they owe RM11.18 bil (average RM9.32k per defaulter), PTPTN chair Norliza Abdul Rahim says. About 30% or 359k borrowers haven’t paid a single cent, owing RM5.25 bil (average RM14.62k per defaulter), while others are earning decent money overseas but still skip repayments that could be as low as RM100-RM200 a month. With so much at stake for PTPTN’s future funding, she reckons it’s only fair to hit them with travel restrictions or other measures so those who can pay actually do.

2 weeks ago, PM Anwar said the government will not rush to introduce new taxes until the administration is free of leakages, corruption and weak management. Here’s an easy RM11.18 bil to collect back. Simply putting into Malaysian Government Securities (MGS aka bonds) with a yield of 3.13% will generate interest income RM350 mil.

Housing ministry hints at travel bans for flaky developers

The Housing Ministry is clamping down on rogue developers by suggesting travel bans for those behind abandoned housing projects. This move, part of a review of the Housing Development Act 1966, is meant to protect homebuyers and make errant developers accountable. Once a project is declared abandoned, the developer and their board get blacklisted, banned from new licences, and have their housing accounts frozen. As of Sep 30, 107 private projects nearly 30,000 units and over 15,000 buyers are abandoned, with Selangor leading the pack. The ministry’s also helping affected buyers by mediating with rescue developers and banks to recover payments and restructure loans.

4. AROUND THE WORLD 🌎

Trump says no to ‘third’ term presidency workaround

US President Donald Trump said he will not be running as a vice presidential candidate in the 2028 election, though he would love to run for a third term if he could. Some of his backers have floated the idea of a different candidate naming Trump as a running mate with the understanding that they would immediately resign the presidency for Trump to take over again. He said that, while he would be “allowed to” try that stunt, he did not think it would have popular support. Instead, he named current Vice President JD Vance and Secretary of State Marco Rubio as a strong Republican team for the next elections. For context, the US Constitution limits the number of times a person can be elected to the presidency to twice.

The move that Trump believes he would be allowed to try takes advantage of the 25th Constitutional Amendment, which states that the Vice President becomes the President should the elected President resign. This, according to the letter of the law, does not count as being elected, which nicely circumvents the 22nd Constitutional Amendment, where no person can be elected as President for more than two terms.

Billions here, billions there

HSBC takes USD1.1 bil hit from Ponzi scheme lawsuit

The bank would book a USD1.1 bil provision (RM4.6 bil) in its third quarter results after losing part of an appeal in a long-running lawsuit tied to Bernard Madoff’s Ponzi scheme, the biggest-ever such fraud in history, estimated at USD64.8 bil. HSBC was a service provider to several funds that invested with Madoff’s investment firm, leading to Herald Fund suing HSBC’s Luxembourg unit seeking restitution of assets lost. The Luxembourg Court of Cassation rejected an appeal by the HSBC unit over the restitution of assets, though it accepted an appeal on a separate cash compensation claim. HSBC plans to appeal further with the Luxembourg Court of Appeal, and should that fail, the bank will contest the amount to be paid. Herald is seeking the compensation of securities and cash worth USD2.5 bil plus interest, or USD5.6 bil in damages plus interest.

AI training firm Mercor hits USD10 bil valuation

Mercor, co-founded by college dropouts Brendan Foody, Adarsh Hiremath, and Surya Midha, is finalising a funding deal that places the startup at a USD10 bil (RM42.1 bil) valuation. The firm has become a critical component of the AI ecosystem due to its role in data-labelling, which is the process of identifying raw data and adding one or more meaningful and informative labels to provide context so that a machine learning model can learn from it. Mercor manages 30,000 contractors around the world to gather such data, many of whom are white-collar professionals. For example, doctors could earn USD170 (RM715) an hour . The firm was initially a human resources and recruiting startup that used AI to automate resume screening and match and screen candidates.

With its focus on technical jobs, Mercor inadvertently compiled a mass network of specialised workers that AI companies are eager to tap to train their chatbots. The value of its network came into focus after tech giant Meta acquired a 49% stake in data-labelling firm Scale AI in a USD14 bil deal, which pushed Scale’s valuation to USD29 bil. However, some of Scale’s customers and competitors were concerned about the startup’s ability to remain neutral, with many turning instead to Mercor, which saw its revenue quadruple since Meta invested in Scale.

Policymaker calls for the Philippine central bank to take profit from gold

Monetary Board member Benjamin Diokno has called for the Philippine central bank to sell some of its gold holdings, which he has described as excessive. This comes against a backdrop where gold prices are set to drop further from record highs as safe-haven demand eases. Gold currently makes up 13% of the bank’s gross international reserves, more than other central banks in the region. The bank bought gold when it was at around USD2,000 an ounce, leading Diokno to question why the bank was not selling the precious metal, considering the recent record high of nearly USD4,400, though this has since fallen below the USD4,100 line.

Shorts

Singapore releases background paper as it mulls nuclear energy

The city-state’s background paper aims to engage the public on the potential of nuclear power in Singapore, with the government seriously studying the potential deployment of nuclear energy, especially with the availability of newer technologies such as small modular reactors. The paper covered Singapore’s capability-building, technology considerations, and provided an overview of its interests in nuclear energy as a power source. Background paper available here.Japanese region calls for military to cull bears as attacks spike

Bears, now a pest. The governor of Japan’s Akita prefecture has called on the military to protect residents from an unprecedented wave of bear attacks. The governor will be meeting with Japan’s new defence minister soon to discuss a potential bear cull. Local authorities reported that 54 people have been injured or killed this year, up from 11 last year, with sightings increasing sixfold to over 8,000 incidents in Akita alone. This also comes amid a record number of attacks across the country this year.

5. FOR YOUR EYES 📺

Before we start, the working link here to yesterday’s nose-blowing done right video. Sorry again.

ASEAN Summit Recap

Trump breaks protocol, giving PM Anwar a ride on the Beast.

BFM compiled some candid highlights (e.g. PM Timor Leste Xanana Gusmao’s robotic walk) and a glaring error.

📍🟡 Key highlights from the 47th ASEAN Summit include:

📌 Timor-Leste officially became ASEAN's 11th member following the signing of the Declaration of Accession, marking the bloc's first expansion since Cambodia joined in 1999.

📌 Cambodian Prime Minister Hun Manet and Thai

— BFM89.9 (@BFMradio)

10:00 AM • Oct 27, 2025

The logistics of moving around the US President abroad. All we can say, it’s really expensive.